Do you daydream of coming into a large, unexpected sum of money? That’s what happened to The Register-Guard a few months ago, shortly before its sale to GateHouse Media.

During its Feb. 13 meeting, the Lane County Board of Commissioners approved a property tax refund of almost $500,000 to the RG.

The refund of $483,844.93 to Guard Publishing Company was approved to correct a clerical error, according to Lane County Assessor Michael Cowles.

Cowles says the RG’s property tax account was split into two separate accounts at one point in time — an improvement account and a land account. When this was done, the maximum assessed value was split incorrectly.

He says the maximum assessed value is “the basis for the assessment for essentially the main tax for the account.”

“It was included on both accounts, and what happened was the land account had the maximum assessed value incorrectly on it and the improvement account had it correct,” Cowles says. “They had the market value of their property increased this past year and they wanted to know why their assessed value increased more than 3 percent on this property because, typically, the maximum assessed value typically only increases 3 percent.”

He says the RG hired a local tax attorney, David Carmichael, to look into the odd increase, which is what led the Assessor’s Office to find the clerical error.

“We did a six-year correction on this, and the $500,000 would be the cumulative of the six years plus the 12-percent interest on the error,” Cowles says.

Cowles says clerical errors like this one happen from time to time, but usually do not result in this large of a refund.

“We do, I wouldn’t say, a lot of clerical errors, but we do a number of clerical errors each month as far as a range in between large dollar amounts to maybe a couple hundred dollars,” he says. “It commonly happens, though this amount is a little higher than usual.”

Approval of the tax refund came less than a month after announcement of the sale of the RG to GateHouse Media — a national media conglomerate — in late January. GateHouse officially took ownership on March 1.

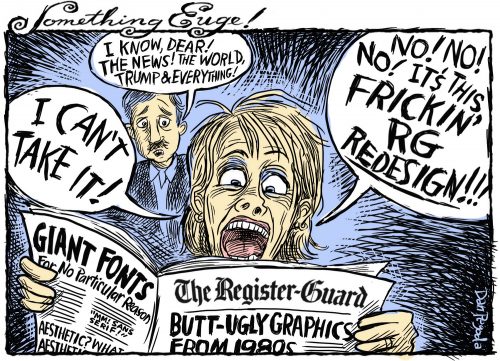

So far, GateHouse’s management of the RG has resulted in layoffs of copy editors and other employees, and copyediting has been outsourced to GateHouse’s Center for News & Design in Austin, Texas.

Cowles says there was no specific reason for the timing of the RG’s tax refund.

“It was just when we had processed it,” he says. “It really wasn’t as far as a certain timing for us, it was just when we found it and processed the correction. It just takes a month or two to do the process of correcting the property and then having the correction made and actually paying it out.”

Eugene Weekly reached out to the RG’s attorney, David Carmichael. “The constraints of attorney-client confidence prevent me from discussing the case of any particular client,” he responded via email.

When asked how common cases like this one are, Carmichael did say, however, “The majority of my property tax cases are residential which, by their very nature, do not commonly result in what I would consider large tax refunds.”