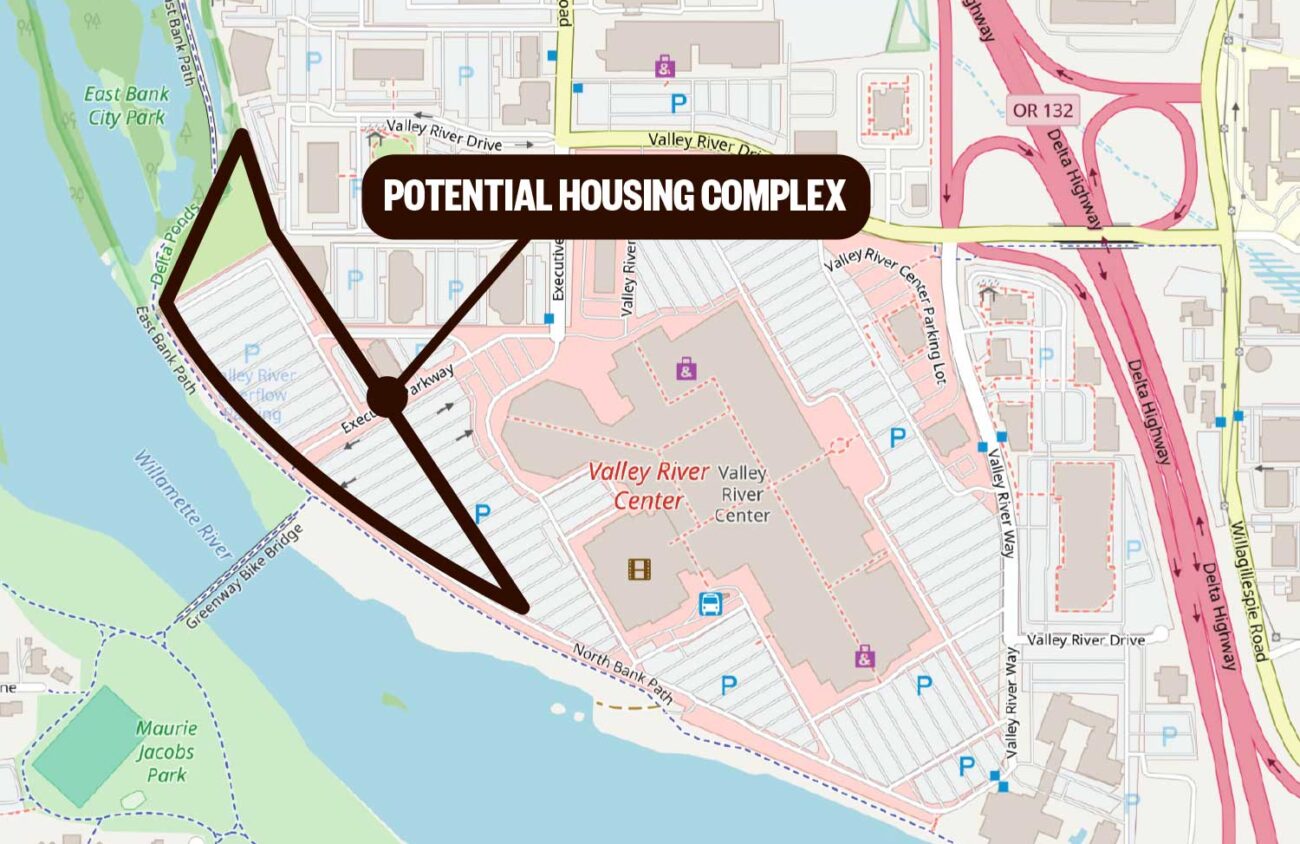

A Seattle developer is exploring whether to build a large condo complex along the Willamette River in Eugene, on land that’s part of the Valley River Center mall.

The company, Blue Fern Development, has tentatively proposed 125 units of condo “townhome style housing” on 11 acres of undeveloped land and mall parking lots that overlook the river and the south part of the Delta Ponds wetlands.

The mall’s owner, financially struggling California-based Macerich, has put the land on the market for $14 million.

Blue Fern is asking the city about restrictions and requirements. A small slice of the proposed site appears to be in a federally designated floodway, a high-danger area where development typically is not allowed, Federal Emergency Management Agency maps show.

Much of the rest of the 11 acres appears to be in the 100-year floodplain, which FEMA’s map describes as a “high flood risk area.” Development typically can be allowed in those areas if certain conditions are met. Many homes and businesses near the Willamette in Eugene are in the 100-year flood zone.

Blue Fern’s website says the company has created building lots and developed townhomes, among other projects, mostly in the Seattle area. The company didn’t reply to questions from Eugene Weekly.

The Eugene complex would have 27 two-story buildings, each containing four or five units, Blue Fern’s plans say. The land is zoned community commercial, which allows housing.

Macerich would need to designate an easement through its VRC parking lots for access to the development, the plans say.

Because they’re many hundreds of feet from the mall buildings, the parking lots aren’t used much by mall customers. But they are popular with folks who park there to bike, jog and walk on the public trail that runs on a narrow strip of city-owned land between the mall and the river.

It’s unclear how long Macerich has been trying to sell the riverfront land. The company declined to comment to Eugene Weekly. Macerich has signed up the Eugene-based Campbell Commercial Real Estate brokerage to market the 11 acres.

Years of losses

Valley River Center occupies about 55 acres, excluding the Macy’s building and its parking lot, which are owned by Macy’s Inc.

Selling some VRC land might help Macerich’s strapped finances — a little.

The publicly traded company says it is trying to reverse years of losses, in part by off-loading real estate.

Macerich owns or has a stake in 43 malls around the country, its filings say. But the shopping-mall model has been sorely pinched in recent years as many traditional department stores have imploded and consumers have shifted to online shopping.

Macerich reported a loss of $91 million for the first six months of this year, following a $198 million loss in 2024, on the heels of a $278 million loss in 2023, according to its filings. Interest payments eat into its finances. It carries $5.2 billion in mortgage debt, the filings show.

Declining value

Not surprisingly, the market value of Valley River Center has sagged.

A retail property such as a shopping mall is typically valued based on how much revenue it generates for its owners: lease revenue from tenants, plus, often, a percentage of each tenant’s sales, known as “percentage rent.” The more revenue for the property owner, the more valuable the mall. And the converse: as lease rates and store sales sour, so does the market value of a mall.

Macerich bought the mall in 2006 from the London-based Grosvenor Group for $179 million, according to the deed. Within a few years, the property’s market value began a long slide, according to Lane County assessment data. Macerich says the property now has a market value of just $66 million. The Lane County assessor’s office pegs the market value higher, at $94 million. The sides have been fighting for several years over who is right, with Macerich arguing for the lower value, as that would cut the property taxes.

Bricks $ Mortar is a column anchored by Christian Wihtol, who worked as an editor and writer at The Register-Guard in Eugene 1990-2018, much of the time focused on real estate, economic development and business. Reach him at Christian@EugeneWeekly.com.