Buying a car is one of the more significant transactions that the average American goes through, especially if the purchase happens at a dealership. The financial transaction often requires a sizable down payment and a financial loan from a bank or credit union.

That monthly car payment is usually second to only rent or mortgage payments. According to a report from Autowise.com based on data from credit report agencies and financial institutions, the average monthly payment for a used car in Oregon is $305 and for a new car $491. And many are stuck with car payments for years. A 2017 report from the U.S. Consumer Bureau shows nearly 70 percent of car buyers are paying off car loans for five to seven years.

So finding a trustworthy place to buy a car is important.

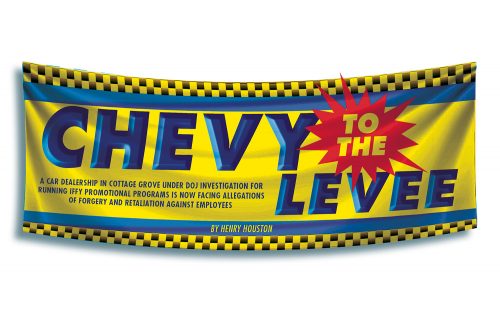

But one local dealership, Brad’s Cottage Grove Chevrolet, is the subject of an Oregon Department of Justice investigation over its use of mailers to bring in potential customers thinking they may have won a prize at the dealership. According to state DOJ interviews with employees in 2019, one employee says Brad’s use of misleading mailers to attract potential customers to the dealership were “circus antics.” The Oregon DOJ says it cannot comment because it is an active investigation.

And a recent lawsuit filed in the Lane County Circuit Court as well as a complaint with the Bureau of Labor and Industries (BOLI) alleges the dealership’s management has retaliated against employees when they have raised awareness about check forgery and forging signatures on documents.

James Gardner, an attorney for Brad’s, tells Eugene Weekly that the dealership is cooperating with the DOJ investigation and says the former employee who filed the lawsuit is “a bad actor.”

Check into Cash

Garrett Taylor has worked as a car salesman for about 12 years. When he worked for Brad’s in 2019, he says he was one of their best salesmen.

“I was very good at my job and was their No. 1 sales guy,” he tells EW. “I worked my tail off for that company, and as I perceived it, it was a good company with the wrong management leading the way.”

EW first learned about Taylor’s case after he filed a complaint with BOLI on Feb. 3 and reached out to his lawyer.

Taylor was supposed to win the “Salesperson of the Year” bonus because he had sold the most vehicles, which came with a pay bonus, according to his complaint.

On Dec. 20, 2019, he met with dealership owner Bradley Cohen, management and coworkers, to say that forgery had been occurring. He says he provided multiple documents to prove his claim, according to paperwork filed in the Lane County Circuit Court against Brad’s.

Taylor tells EW that he doesn’t want to sound like he’s bashing his former employer because for the nine months he was there, the company provided him and his family with the opportunity to make a reliable paycheck. But he says he wanted to come forward to the dealership management about the wrongdoing that was happening to avoid yet another DOJ investigation.

At first creating fake paychecks was done for friends of the general manager, he says.

“There were a lot of female strippers who the general manager was associated with. And they could not provide pay stubs for proof of income,” Taylor says.

Because professions like exotic dancing generate a lot of tips, some of which might not be reported as income, the dealership’s management created fake pay stubs to provide the bank as proof of income.

When that was working fine, Taylor says the pay stub forgery then expanded to include unknowing customers.

Taylor says in general a car dealership is the middleman that has access to all aspects of a sale: It can see the customer’s paystubs, as well as whether a customer can qualify for a bank loan. So the bank didn’t know the pay stub was altered and neither did the customer.

A result of forging a pay stub to secure a bank loan is that the customer can be stuck with a high car payment that could end in repossession, he adds.

EW obtained a copy of a real paystub and one allegedly falsified by Brad’s. In a real paystub from a popular Oregon fast food seafood restaurant, the net pay shows $400.72 based on 40 hours of work with $12.47 hourly rate.

In the faked version, the employee has a net pay of $790.58 at 78.64 hours of work with a $13.25 hourly rate.

Taylor isn’t the only former employee who came forward about management demanding staff break the law. Although the person denies he filed the complaint, a complaint sent to the DOJ in 2019 alleges the general manager demanded that all sales staff break the law and lie to customers by fluffing people’s income on credit applications to help secure financing as well as lie about interest rates and how much customers pay for cars.

Gardner, Brad’s attorney, says Taylor has a criminal history and a motive to fabricate documents. He adds that the dealership had reported him to law enforcement for alleged fraud. Although Taylor had criminal charges in 2017, Brad’s still hired him in 2019.

On Dec. 31, Taylor’s manager told him he would not receive the “Salesperson of the Year” bonus. According to Taylor’s BOLI complaint filed Jan. 24, a few days later the manager decided to give him the bonus anyway, which he had already promised to Taylor’s coworker.

Taylor alleges he learned of another illegal practice at the dealership: The manager asked him to sign a cancellation check. He says a cancellation check is when a customer trades in a car that has life on the warranty left; the customer is entitled to the remaining money.

Taylor’s manager asked him to forge a customer’s name on a cancellation check. He says in that case, the customer owed some money for a down payment for a recent car purchase and the cancellation check would be applied to it.

“I’ll never sign anybody’s name other than mine. Whether or not a customer says it’s OK, it’s a crime,” he says.

The next day, Taylor says, he was locked out of his computer and all sales leads were given to his coworker. After he confronted the manager about being locked out, he was given access again. But all of his emails and sales leads were still erased, he alleges in the BOLI complaint.

“That is information that I need to do my job, and I cannot sell vehicles without leads,” Taylor writes in his BOLI complaint. Among other duties, BOLI protects employees from unlawful discrimination, retatliaion and harrassment at the workplace.

Taylor withdrew his BOLI complaint after the state agency granted him a right-to-sue, according to court documents.

The dealership allegedly employed a violent felon who threatened to kill Taylor and his family, according to a recent court filing. The dealership said it fired the employee but Taylor alleges the felon was paid by the dealership to stay in a hotel less than 100 yards from his home to threaten him.

According to court documents, Taylor is seeking $500,000 in damages.

Always Be Closing

In 2018, Michael Whitney received a mailing that said he could win up to $25,000 in cash, a 60-inch TV, $3,500 in cash or a $5 bill. He pulled a tab from the mail and scratched a piece off. The numbers matched up, signifying he won. To find out what he won, he had to call a hotline number, which he did.

“A woman came on the line, and I indicated that it looked like I had won a prize from Brad’s Chevrolet,” Whitney recalls in a letter to the Oregon DOJ. “She then asked me for my name, which I gave her. She then asked what sort of car I drove.”

The woman then made an appointment for Whitney to collect his prize at 11 am. While at the dealership, Whitney says he overheard another prizewinner tell a salesman that he won $3,500. The salesman replied “that it was just a way to get you into the business where you could see how nice we are and build up a relationship,” according to the letter that EW obtained through a public records request to the DOJ.

Whitney ended up driving 30 miles each way from his home to the dealership to spin a prize wheel that landed on a $1 prize.

Sending the mailers is a way of attracting new customers who aren’t actively looking for a new car to the dealership, according to former Brad’s employee Andrew Burns’ interview with the DOJ in October 2019.

DOJ interview transcripts of sworn statements by Brad’s employees from its active investigation into the dealership show that what Whitney actually won was the chance to spin a prize wheel during a promotional period spearheaded by a third party contractor. Employee interviews with DOJ paint a picture of the dealership’s employee base that had problematic experiences with a company that used “deceptive” promotional methods to get customers in the door. And one employee who participated in the interviews alleges that he experienced employer retaliation for talking too much with the DOJ.

Burns filed a BOLI complaint in February 2020; in it he says the dealership retaliated against him for reporting it was defrauding customers. The first time Burns told the dealership’s management about the practice was in January 2018, according to the complaint.

Burns said the dealership continued to hire a third party to do the sales events that involved mailing fraudulent flyers, like the one that hooked Whitney into Brad’s.

According to a mailer submitted to the DOJ, it was mailed to residents who lived within a 69-mile radius of the dealership. The mailer that Whitney received showed the odds of winning a $5 bill was 99.5 percent likely, but a $1 bill was not included on the mailer.

When Burns told management about his uneasiness about the use of the flyers, management told him that he could quit if he didn’t like it, according to his BOLI complaint.

On Oct. 24, 2019, Burns spoke with the DOJ about the dealership’s use of prize promotion flyers and changing car prices on the internet. In his interview, he says the Oregon Office of the Attorney General became aware of the mail flyer sale during June 2018. And the dealership continued to mail the flyer despite being under investigation.

The prize promotion events that he experienced at the dealership were “a bunch of circus antics,” Burns told the DOJ.

He added that the dealership hired a subcontractor, Automotive Expert, that was well versed in working with the system. The company, he said, provides salespeople who “come to the dealership that understand how to handle the customer that comes into the dealership believing they won a prize and then turn that into a vehicle transaction.”

Burns said he never participated in the tactic and told the DOJ it was deceptive.

“They tell the customer that this is the greatest deal ever, and we’re going to pay you a lot, and you’re going to be so happy, and it’s just fanfare,” he testified.

And what attracts customers to the car lot in the first place is that promise of spinning a prize wheel. Customers think they won a big prize but it’s really just a chance to spin the wheel, he said. The dealership was known to take the higher prize off the wheel, too, he said, whenever the dealership was running out of cash.

Burns told the DOJ that the job of the contractors is to “turn that customer from an unhappy, pissed off customer that thought they won into somehow selling them a vehicle.”

But customers who came in to claim their prize didn’t like the sales tactics, he added.

“Multiple salespeople from the crew would just keep pushing, and if one guy didn’t do it, then they would bring two guys in,” he said. “Then they would bring three in, and pretty soon they would be surrounded with strangers standing over them.”

What Burns was reporting to the DOJ is similar to what the Indiana Attorney General’s Office cracked down on in 2019. That office went after six companies that conducted similar promotion campaigns that deceived potential customers to come to the dealership.

Although one company is still awaiting its case, five others were hit with fines from $57,500 to $2.6 million.

Betsy DeNardi, director and chief counsel of the Consumer Protection Division in Indiana, tells EW that those cases were brought under two statutes: the Indiana Deceptive Consumer Sales Act and the Indiana Promotional Gifts and Contests Act.

Under that state’s law, promoters that send out mailers have to include the promoter’s name and address, as well as odds of winning the prizes, DeNardi says.

In one case, against Traffic Jam Events LLC, the promoter sent out mailers to residents, all of which said the recipient won $5,000, according to court documents. But when they went to the dealership after hearing a sales pitch, they went home with $5 gift cards to either Walmart or McDonald’s.

Traffic Jam Events, LLC, paid $57,000 in a settlement, which an attorney for the company says doesn’t constitute a violation of the state’s statutes.

Under the Indiana statute, DeNardi says if someone has to hear a sales pitch for a good or service to pick up a gift, that has to be listed on the mailer.

After Indiana’s Office of the Attorney General pursued action against those companies that managed promotional programs for car dealerships, DeNardi says there have been fewer complaints coming into the office. She adds that although she would like to think the state’s cases have caused change, she can’t say whether that change has happened.

Oregon’s Unlawful Trade and Practices Act prohibits the use of deceptive advertising. Under the act, a business is barred from making false or misleading statements about prizes, contests or promotions used to publicize a product, business or service.

Talking about the prize promotion program wasn’t the only issue that drew the ire of Brad’s management to Burns.

Burns also told the DOJ how many times a previous general manager had demanded that subordinates change internet prices to deceive customers, according to his BOLI report.

Burns told the DOJ that dealership management told him to change car prices on the internet about 50 times, but he refused to do it. Burns said that if a customer had not seen a car’s price online, the manager would tell another subordinate to change the price to a couple thousand dollars more than the advertised price was on the car lot.

In his interview with the DOJ, Burns pointed to a specific car sale in June 2019. The customer came in to look for a new Chevy Traverse, and the manager of the dealership suggested a used current year model. The online price for the car was much less than what it sold for, $3,000 to $4,000 less. So the manager asked an employee to change the price before the customer completed the transaction.

Burns added that although he couldn’t specify the number of times the dealership changed the online price of a car after the customer paid more than the advertised price, it happened between eight and 10 times in June 2019.

Burns’ BOLI complaint also alleges he experienced threats from a coworker and suspension for telling the DOJ how many times the dealership changed its internet prices.

“At the end of October, respondent’s owner, Bradley Cohen, told me ‘You need to shut your mouth,’” Burns alleges in his BOLI complaint, a statement that was caught on video camera.

On Jan. 21 this year, Burns said in his BOLI complaint that Cohen called him on his work phone and called him a “pussy” and a “prick” who deserved to have his ass kicked. Cohen then added that Burns would be suspended.

Unlike Taylor, Burns’ BOLI case didn’t end up in a lawsuit. His lawyer says Burns died earlier this year. And management involved with the alleged internet price changes and promotional flyers no longer work at the dealership, according to the 2019 DOJ interviews.

Despite what Taylor experienced at Brad’s, he says he hopes the dealership cleans its act up — because many employees depend on the paycheck to feed their families.

For more information on how to file a consumer complaint on a business in Oregon, visit Doj.State.or.us/Consumer-Protection or call the hotline at 1-877-877-9392.

This article has been updated